Repeatable processes and proven templates help improve your PCI DSS compliance maturity as well as save you time so that you can focus your attention on assessing evidence or continuous compliance.

In PCI Compliance Essentials we’re dropping serious nuggets of wisdom to help organizations get everyone from system administrators, incident response handlers, billing, C-level executives and everyone else who has a piece of the PCI pie ON THE SAME PAGE and speaking THE SAME LANGUAGE.

Unless you’ve been living under a rock, PCI DSS v4.0 goes into effect on March 31, 2024. Here’s 4 key PCI DSS Compliance processes that you need to have in place by year end.

I’ll be the first to admit that continuous PCI Compliance was beyond my grasp when I started my PCI journey in 2012. I was doing my best not to drown in a sea of confusion and chaos.

If something like our newest course, Implement Continuous PCI Compliance, existed a decade ago, I would have been all over this.

Read More!

10 Insider Secrets From a Recovering PCI ISA

Does this sound familiar?

“I feel like a fraud.”

“I have no idea what I’m doing.”

“How do I know if this evidence meets the PCI DSS requirement?”

“I don’t know how to tell a senior director their software development process is neither secure nor PCI DSS compliant.”

Running or being in charge of a PCI Compliance Program feels like you’ve been given the weight of a thousand worlds to carry.

You have all of the responsibility and zero authority.

It’s like being stuck in a dingy in the middle of the Pacific Ocean.

So, how do you get past feeling like a fraud who’s adrift in a vast ocean without any paddles?

I know how overwhelming running a PCI DSS Compliance program is.

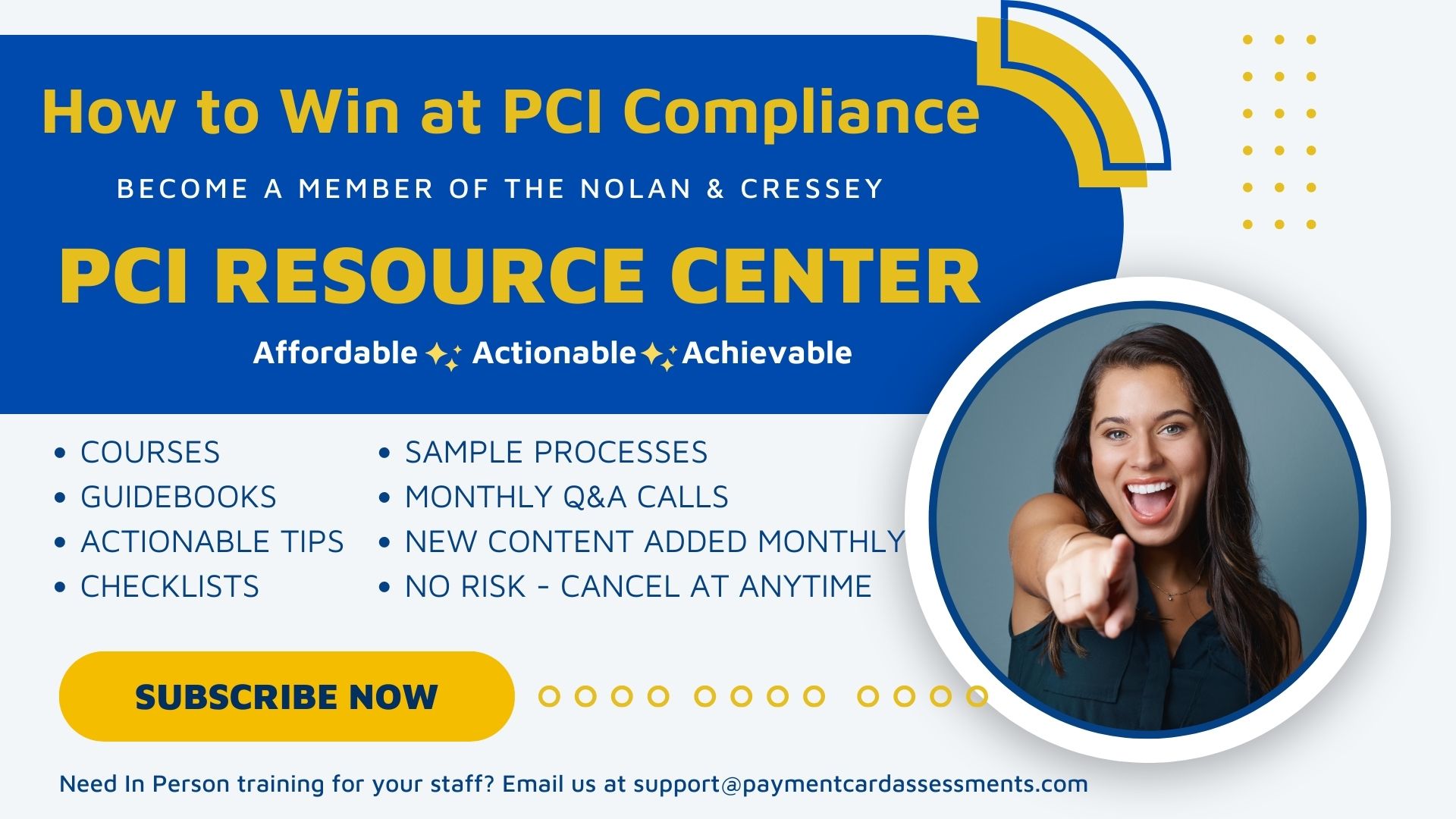

That’s why I’m sharing How to Win At PCI Compliance: 10 Insider Secrets From an Ex PCI ISA with you today.

I want help you feel more confident and less adrift.

Keep Reading!

Don’t Start Your 2023 PCI Report on Compliance Without Doing These 10 Essential Tasks FIRST:

The end of the first quarter is quickly approaching. It’s time to get your PCI Compliance house in order.

Because nobody wants to be the next Landry’s and have a $20M fine upheld by federal court.

1. You have a copy of the signed Statement of Work with your QSA

Make sure you have this statement of work at your fingertips throughout your assessment period. This agreement protects you and your QSA for work that is contractually agreed upon.

2. Complete an end-to-end PCI Scope Assessment

The success of your PCI Report on Compliance hinges upon an accurate PCI Scope Assessment.

Your scope assessment includes the who, what, where, when, why, and how of your cardholder data environment and anything or anybody that connects to your cardholder data environment.

Have you almost quit your PCI Compliance job after submitting your organization’s Report on Compliance?

Don’t be shy. It’s okay if you walked away.

I almost quit I submitted the first PCI Report on Compliance I ever worked on.

December 21, 2012 a day that still dredges up heartburn.

But…

I didn’t quit.

I didn’t walk away.

Instead, I saw the opportunity to build a world class PCI DSS Compliance program.

You can do PCI Compliance the Smart Way or the Hard Way. Which way do you choose?

You know that saying, “objects appear bigger in the rearview mirror,” right?

When it comes to PCI Compliance, satisfying the requirements often looks bigger the more you stare at them. And when you look at the requirements in isolation, they often look next to impossible to implement. Your brain (and my brain) want to over complicate what needs to be in place to secure the cardholder data environment.

Maybe you jump immediately to implementing the newest shiny security tool without thinking of how it will impact other in scope systems.

Maybe you leap to more complexity by adding layers of security controls and processes when one solid, repeatable process will do.

Or maybe you bury your head in the sand and sing lalalalalalalalalalala….(honestly, there were days I wish I could’ve done that!)

PCI Compliance doesn’t have to be complicated.

Here’s 4 smart ways to stop overcomplicating your PCI Compliance program:

Wait a second.

There’s a painless way to complete a PCI Report on Compliance?

You’ve got to be kidding me.

I’m not kidding you.

Ready? Keep reading!

I wish I had had the PCI workshops and resources that included easy to follow directions and targeted training back in 2012.